Flexible spending accounts (FSA) are underutilized. If everyone knew they could save 20% off their health care bills, the story might be different. The discount every person receives will depend on their tax rate.

There are two types of pre-tax FSAs. One account is for dependent children and the other is for healthcare expenses. For the tax year 2017, you can elect to allocate a maximum of $2600 for health care. The maximum allocation for dependent care is $5000.

A dependent-care flexible spending account can be used to pay for dependent care services, such as day care, preschool, summer camps and non-employer-sponsored before or after school programs. It can also be used for elder daycare when an elderly or disabled parent is considered a dependent and you are covering more than 50% of their maintenance costs. For many parents like me it’s much easier to get an idea of how much you spend on dependent care than health care.

Deciding How Much to Put in a Health Care FSA

Health care flexible spending account expenses include doctors' visits, prescription medications and glasses. If eligible, see your plan’s rules for a complete description of qualifying expenses. If you and your spouse each have a health care FSA, you may each contribute up to the annual maximum, however you may not submit the same claims to both accounts, and you may not transfer funds between them. Figuring out health care spending is a bit more complex for most people. First, we don’t want to have health care expenses. Who wants to be sick? Second, the expenses for doctors, hospitals, clinics and drugs are much more complicated. (For related reading, see: How Flexible Spending Accounts Work.)

To get an idea of how much you'll want to save in your FSA, you can look at past statements from your insurance company, hospital, doctors and pharmacies. Many people pay for their medical expenses on their credit card and don’t think too much about it. However, if they could essentially pay $0.80 and get a dollar of care, they may look at things differently.

Examples of FSA Tax Savings

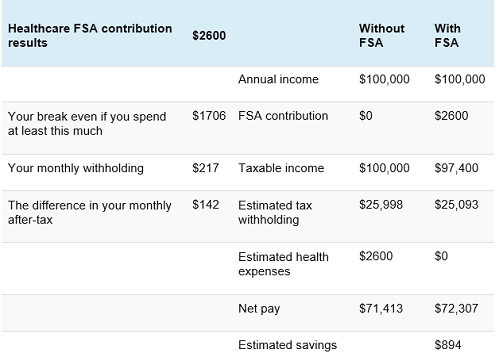

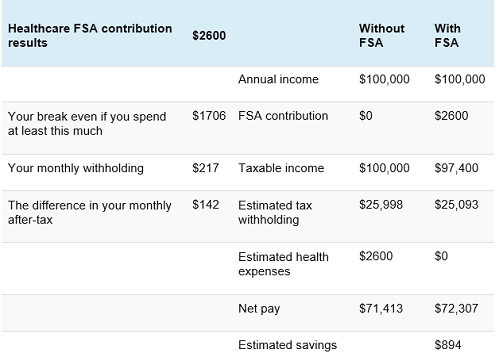

The following examples show results from a Google search for FSA tax savings calculators. They assume a married couple making $100,000 with two dependent children and using the maximum FSA amounts. The total saved was $2026. Your actual individual savings would be based on your income, marital status, dependents, etc. See your tax advisor for tax advice to discuss your particular situation.

If You Contribute Your Total Anticipated Health Expenses to an FSA*

If You Contribute to a Dependent Care FSA

Don’t Flex Spend the Savings

The tax savings you receive should not be treated like extra cash. Consider adding it to an emergency fund or 401(k), or opening an IRA.

(For more from this author, see: How to Maximize the Use of Your HSA.)

*The IRS limits your maximum annual contribution to $2600 in 2017. Your employer may also set limits on your maximum annual contribution, as well as which products and services are FSA eligible. Please check with your employer’s benefits representative before making a final decision. The estimated tax savings provided are for illustrative purposes only, and should not be construed as tax advice. Consult a licensed tax professional for appropriate advice given your individual situation. Plan your FSA contribution carefully, since any unused funds will be forfeited following the end of your plan year or any grace period thereafter.

cr. https://www.investopedia.com/advisor-network/articles/flexible-spending-account-rethinking-use-it-or-lose-it/

ไม่มีความคิดเห็น:

แสดงความคิดเห็น