If you are an investor, you may be feeling the impact of the 2017 market correction. Perhaps there were losses in certain asset classes, or specific investments decreased in value. Your first reaction may be emotional, or you may feel there isn’t much you can do about it. But what if I told you a market correction could deliver a hidden benefit—a benefit you may be able to leverage to save on your taxes? Tax-loss harvesting is a hidden benefit of a market correction, and it is a valuable tool for many investors.

Use Tax-Loss Harvesting to Offset Taxes Owed on Capital Gains and Income

Tax-loss harvesting is a short-term strategy involving the sale of stocks, bonds and mutual funds that have lost value to offset taxes owed on capital gains and income. Regardless of what you sell, you cannot purchase the same asset (or a substantially identical asset) for a period of at least 30 days. That being said, if all or most of your investments are in your 401(k) or IRA accounts, tax-loss harvesting will not be an option for you. Only accounts that are taxable can qualify for this strategy. Here is a brief overview of the strategy:

- Investor holds an investment in his or her portfolio that has experienced a significant loss.

- Investor is looking for a way to reduce taxable income. Many high-net worth individuals find themselves in the highest tax bracket, 39.6%, so this reduction can mean large tax savings.

- Investor sells the asset(s) that experienced the loss.

- The loss serves as a deduction against capital gains, or a deduction against taxable income (if the investor has no capital gains), thus reducing taxes owed for the calendar year.

The amount you can deduct depends on whether or not you’ve experienced a capital gain for the year, and whether the gains were short-term or long-term.

Examples of the Process and Potential Savings

Here are some examples that illustrate the process of tax-loss harvesting and the potential savings.

Example 1: Investor realizes a significant long-term capital gain

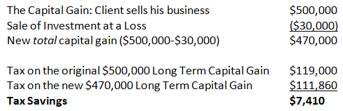

In our first example, the investor has sold a business he’s owned for many years. Excited about the prospect of moving on to his next phase, he’s also concerned about the large tax liability he’s facing as a result of the sale. What strategies can he put in place to lower the tax bill? In his portfolio, the investor has an investment that is currently underperforming—an investment he could sell at a loss to take advantage of tax-loss harvesting. Here’s how the numbers worked out:

As you can see, the client was able to reduce his tax bill significantly by leveraging the tax-loss harvesting strategy.

Example 2: No capital gains are present for the taxable year

So what happens if you haven’t realized a capital gain, or your losses outweigh your gains? You may still deduct up to $3,000 of capital losses per year from your income. In other words, if you sell an investment at a loss and have no other capital gains, you may deduct up to $3,000 from your taxable income for that year. In this example, if are in the 30% tax bracket, this could be a potential savings of $900 in taxes. If your losses total over $3,000 for the year and you still have no other capital gains, you can carry forward the excess loss and apply it to future years’ gains or income. For example, if your losses are $5,000, you may deduct $3,000 for the current year and carry forward the excess $2,000 to use as a deduction against income or as an offset against capital gains in a future tax year. (For related reading, see: Capital Losses and Taxes.)

Consider Which Assets to Sell at a Loss

Keep the following in mind as you consider which assets to sell at a loss for tax-loss harvesting purposes:

- Analyze your portfolio to identify any asset classes or individual investments you hold that no longer fit your overall strategy.

- Know you may re-purchase an investment after 30 days following the sale, so consider what that investment may be doing 30 days from now. If you believe the current price will hold steady (or even decrease), and it’s something you’d like to hold in your portfolio long-term, it may be a good candidate to sell at a loss now.

- Make sure you understand and have records for your original purchase price so you can accurately calculate what your loss will be before selling. This will assist you in making an educated decision. (For related reading, see: The Art of Cutting Your Losses.)

Why This investment Strategy May Not Work for You

Like any investment strategy, and the decisions associated with it, there are scenarios where tax-loss harvesting may not be a wise choice. A potential risk with tax-loss harvesting is how that investment may perform during the 30 days following the sale. If you are convinced the price of the investment may increase by more than the tax benefit you’ll receive, it is not wise to sell it today. If you are in a lower tax bracket, tax-loss harvesting may not be an appropriate strategy for you because the taxable benefit realized may not be significant enough to justify selling an investment at a loss.

Tax-loss harvesting is a short-term strategy, and investors must be keenly in tune with when (and if) they should get back into the investment being sold. Regardless, investors should account for the potential changes to asset allocation within the portfolio that may occur as a result of selling the particular asset. Some investors hold onto the cash and keep it out of the market for a period of time, while some invest right away in a different type of investment. If you decide to keep the cash out of the market, I would recommend not spending it immediately.

Tax-loss harvesting can be a powerful strategy. However, the outcome of this strategy will vary based on your particular situation. It is important to make a thorough investigation into the strategy and how it will impact you so you can make an educated decision about whether it is right for you.

(For more from this author, see: When 401(k) In-Service Withdrawals Make Sense.)

cr. https://www.investopedia.com/advisor-network/articles/tax-loss-harvesting-tax-saving-strategy/

ไม่มีความคิดเห็น:

แสดงความคิดเห็น