Both interest rates and stocks soared after the U.S. election. This is because everyone seems to agree that the new administration will spend a lot, collect less in taxes and cut back financial regulations. This is a mix that could fuel the economy and be good for stocks. But not so with bonds. We are likely to see higher interest rates as inflation rises, the Fedfights it with higher policy rates and firmer economic activity pushes market rates higher.

And these policy and market changes could also backfire on stocks if high inflation and higher wages actually drag economic activity down. Furthermore, higher U.S. rates relative to rates abroad are sure to push up the U.S. dollar, hurting exporters and manufacturers. This could also weaken the economy, bring down corporate revenue and dim prospects for stocks. (For more, see: Managing Risk Instead of Trying to Beat the Market.)

This would be a worst case scenario of higher nominal rates and a decelerating economy. It is known as stagflation, and it has a reserved spot next to deflation as a nightmare scenario for policymakers.

Also, the economic policies that the new administration has so far hinted at are radically different from what has been the norm in the past few decades. This guarantees that they will face strong headwinds before they can be implemented, including congressional opposition. There is a chance that the consensus scenario may never materialize, may be watered down or may take far longer than the market is willing to wait. So the optimism about stocks can prove to be short lived.

Private Debt and the Market

Regardless of whether stocks go up or down, it is quite likely that interest rates will remain above the historically low levels of last year or climb even higher. This could exacerbate vulnerabilities in the economy that have so far gone relatively unnoticed. One such issue, and a well-known trigger of past crises, is a large accumulation of private debt.

Debt is a key factor in lubricating economic activity. Households use it to buy homes or cars that could not otherwise afford, businesses use it to finance investments or fulfill orders in advance of payment, municipalities use it to pave roads and lay out utilities and so on. Without debt, growth would be slow, halting, and ultimately impossible. Households, businesses and governments always carry debt on their balance sheets and constantly take new debt to replace the one that comes due. When rates go up, the cost of rolling over debt goes up as well. That is why higher rates tend to dampen economic activity, which is a normal swing in the business cycle.

But when indebtedness becomes too large, the balancing act of renewing old debt with new becomes more difficult to pull off for reasons other than cost. Lenders start questioning the sustainability of the process, especially if rates go up sharply, and sources of funding dry up. Large debt accumulation then leads to a liquidity crisis, just when access to financing is needed the most.

The last few years of ultra-low interest rates sparked a massive increase in U.S. business debt. The opportunity to borrow at some of the lowest rates in recorded history was too good to pass up. But the new debt has not been used primarily to invest in the economy – much went to build cash reserves and some more to buy back stocks or increase dividends. In the last couple of years, private domestic investment has gone down while the stock of private debt continued to grow. (For more, see: Why Bonds Collapse and What You Can Do About It.)

Corporate Debt Levels

The earnings-to-net-debt ratio for S&P 500 corporations – a key measure of borrowers’ ability to reduce their debt levels – is at its lowest level in at least a decade, according to the research firm Factset. And while some analysts find comfort in the fact that corporate cash is also very high at $1.75 trillion, the reality is that much of it is concentrated in just a few technology companies: Google (Alphabet Inc.), Apple, Microsoft, Cisco Systems and Yahoo account for a third of all U.S. corporate cash.

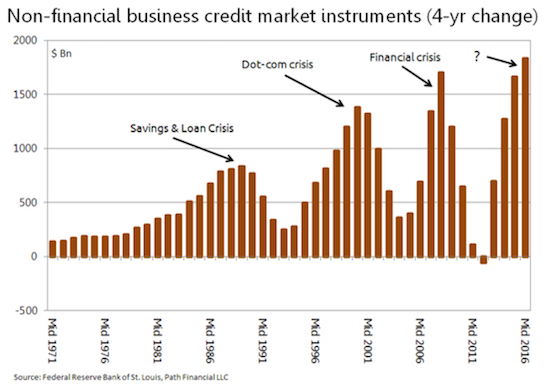

The below chart shows that there has never been a larger or faster four-year accumulation of non-financial business debt. Not surprisingly, prior surges of indebtedness ended in tears.

This is not solely a U.S. problem. China, most pointedly, has seen an explosive ballooning of private, non-financial corporate debt that just reached an eye-popping 170% of gross domestic product (GDP).

Some early signs of a brewing debt crisis would include an increase in corporate credit rating downgrades, Chapter 11 restructurings, liquidity problems in the bond market, and so on. So far, these symptoms are not evident, but conditions could turn optimal for a debt crisis if interest rates rise quickly, budget deficits get out of control, and economic activity does not pick up.

Even without a sudden crisis, it remains to be seen how the mountain of global corporate debt can be gracefully wound down without anyone getting hurt. History shows that large debt accumulations rarely end up well. Close attention to any early warnings will be crucial to navigate through the rest of 2017 and beyond.

What Can Investors Do?

We believe that portfolio management focused on measuring and managing risk can be very effective at creating a sensible balance between risk and return, partly by measuring financial and investment conditions often and adjusting portfolios through a well-defined process. (For related reading, see: Why You Should Diversify and Rebalance.)

cr. https://www.investopedia.com/advisor-network/articles/011917/how-high-levels-debt-could-impact-economy/

ไม่มีความคิดเห็น:

แสดงความคิดเห็น