The individual 401(k) vs SEP IRA debate has raged for years. That might be a bit of an exaggeration but it’s still a conversation I have with small business owners and their tax professionals. We all want to know which is best, but most often it’s simply a matter of pros and cons. What is best for one person might not be best for another given the circumstances. To compare apples to apples, we’ll look at these pros and cons assuming the self-employed individual has no employees.

The individual 401(k) vs SEP IRA debate came about as a result of the Economic Growth and Tax Relief Reconciliation Act (EGTRRA). Up to that point, the SEP IRA had been the go-to retirement account for self-employed individuals without employees. Even today, I frequently hear people asking if they should open a SEP IRA. This usually occurs when someone starts receiving 1099 income either from a side business or from a new endeavor where they are no longer a common-law employee.

Despite the fact that the individual 401(k) has been around since 2001, most people think of the SEP IRA first. It’s somewhat like people referring to all soft drinks as a “Coke.” More likely, it is the result of a lack of tax planning. SEP IRAs can be opened at tax time for the prior year, unlike 401(k) plans that need to be opened by December 31 (more on that later). (for related reading, see: Last-Minute Tax Deduction Moves—by April 18.)

Individual 401(k) vs SEP IRA When You Haven’t Planned Ahead

After years of frustration working hard to make someone else rich, you go out on your own. You’ve finally taken the leap and joined the ranks of the self-employed or self-inflicted depending how you look at it. Business is great and you’re busy serving clients and expanding your burgeoning empire. When you finally start doing your taxes in February or March you realize you need to reduce your tax bill. In this case, the SEP IRA wins. It’s not because it’s the best option. It’s your only option. The reason is because it’s too late for an individual 401(k). But fear not. You’re not stuck with the SEP IRA forever. (For related reading, see: When Are Simplified Employee Pension (SEP) IRA Contributions Due?)

With a SEP IRA, you can open the account at tax time for the prior year. For example, you’re doing your 2016 taxes in March of 2017. No problem. You can open the SEP IRA, fund the account, and receive a nice tax deduction for 2016. Even for those who file an extension, you can open the SEP IRA in September and still get a deduction for the prior year.

How Much Can You Deduct From the SEP IRA?

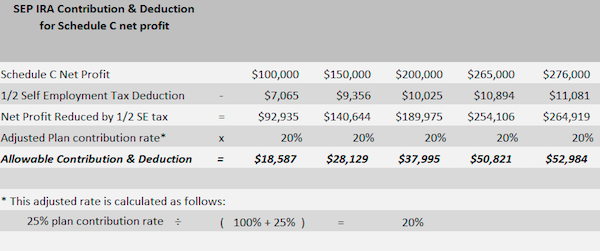

The most common number we hear for maximum contributions is 25% of compensation. But there’s a little more to it when we’re dealing with Schedule C income for a sole proprietor, a partner in a partnership or an LLC. Two adjustments need to be made:

Schedule C net income needs to be reduced by half of the self-employment tax.

The plan’s contribution rate is adjusted by the rate table in IRS Publication 560. The short way to make this adjustment is by taking the plan contribution rate of 25% and dividing by 100% + 25%. The adjusted contribution rate is now 20% (25%/125% = 20%)

The chart below provides the allowable contribution and deduction based on various amounts of Schedule C net profit. You will notice that the $265,000 in Schedule C net profit doesn’t get you to the $53,000 annual limit. It results in a $50,821 SEP IRA which is a little over $2,000 short. And so it goes for the self-employed (self-inflicted). Another kick to the groin! Your Schedule C net profit needs to be at least $276,041 to hit the $53,000 IRS limit.

How Much Can You Contribute to an Individual 401(k)?

With the individual 401(k), you still need to make the adjustments for Schedule C net profit that you do with the SEP IRA. However, there are two significant differences consider:

- Salary Deferral Contribution: With the individual 401(k), you can contribute $18,000 in salary deferral in addition to the profit-sharing contribution. This allows a larger tax-deductible contribution than the SEP IRA with the same level of income.

- Catch-up Contributions: With the Individual 401(k), you are eligible for catch-up contributions if you’re 50 or older. This provides an additional $6,000 worth of tax-deductible contributions with the individual 401(k) vs SEP IRA. (For related reading, see: Independent 401(k): A Top Retirement Vehicle for Sole Proprietors.)

Beware of the Individual 401(k) IRS Form 5500-EZ

Some of the big obstacles to establishing a retirement plan for business owners is the time and costs involved. Individual 401(k) and SEP IRA plans make it possible to have a plan that is both low-cost and easy to administer. However, if you’re not careful you might be in for a surprise.

Unlike SEP IRAs, traditional 401(k) plans are required to file a tax form each year known as IRS Form 5500 or 5500-SF. Which form you file depends on the size of the plan. These forms require a skilled professional to ensure it is done properly. Most often a pension accountant or third-party administrator will prepare this form and help make sure the plan sponsor is complying with the rules and regulations.

Individual 401(k) plans are exempt from these annual tax filings until they reach $250,000 in assets. Once the individual 401(k) plan hits this level, you must file the IRS form 5500-EZ. Don’t let the “EZ” part fool you. If you’re not familiar with retirement plan accounting and various IRS rules on the subject, proceed with caution. Even better, consult a professional to assist you with the preparation. (For related reading, see: Solo 401(k) vs. SEP: Which Is Best for Biz Owners?)

Most people start out in the individual 401(k) plan thinking it will take a few years to hit $250,000, so they don’t give much thought to the annual filing requirements. But because many of these plans allow for incoming rollovers from other retirement accounts, this threshold may be reached much sooner than initially anticipated.

Filing these tax forms takes time and money. Failing to file can cost more time and money. The due date is the last day of the seventh month after the plan year ends. For calendar year-end, this would be July 31. Don’t assume that your investment provider or custodian is going to file these forms for you. Be sure you know the filing rules and stay off of the IRS’s naughty list.

While there are many similarities between these retirement accounts, they are very different animals. In the next part of this series, we’ll look at Roth contributions, loan provisions and deadlines for funding individual 401(k)s vs SEP IRAs.

cr. https://www.investopedia.com/advisor-network/articles/022717/individual-401k-vs-sep-ira-deductions-contributions/

ไม่มีความคิดเห็น:

แสดงความคิดเห็น